You’re crazy if you don’t start in the cloud;

you’re crazy if you stay on it.

For some companies, working with cloud services or moving their entire IT to the cloud is a matter of course. These include, in particular, relatively young companies — such as startups and companies that need to be as flexible as possible due to their specific work structure. Yet for some companies at other stages of their development, working entirely in the cloud could potentially become a dangerous cost trap that inhibits further growth. Today, we take a look at the numbers behind the assumption that cloud services can become genuinely expensive — for some companies at some time — and show ways to define, estimate and, if necessary, reduce these costs.

Recent figures from 2021 and 2022 show that cloud services have gained acceptance even in national economies where they initially had a somewhat harder time. This also includes Germany. However, the fairly clear results of current cloud surveys show that the cloud has finally established itself as an operating model in Germany as well. Only three percent of the 550 companies with 20 or more employees surveyed said they were generally not familiar with the topic. On the other hand, 82 percent already rely on cloud infrastructures. Private cloud implementations are used by 63 percent, while 46 percent use public cloud offerings. These figures represent growth compared to previous years — at the same time, some of them are well behind those from the US or some Asian countries.

Cloud invoice as a potential growth accelerator

In an animalistic and recommendable article, Andreessen Horowitz provides us with numerous figures to illustrate the possible "cost trap cloud". This also contains the sentence quoted above

"You're crazy if you don't start in the cloud; you're crazy if you stay on it";

what is meant by this? The initial move to the cloud is the logical step for many small companies and startups. Figures show that while the cloud clearly delivers on its promise at the beginning of a company's journey, the pressure it puts on margins can outweigh the benefits as a company scales and its growth slows. This is usually not the case until the later stages of a company's development — but can the (partial) exit from the cloud still succeed then? In most cases, simply not. The more or less comprehensive path to the cloud makes it difficult to reverse; reprogramming or significant restructuring required to drastically improve efficiency can take years and is often considered too unprofitable by management.

Meanwhile, there is awareness throughout the business community of the long-term cost implications of cloud services. With cloud costs beginning to represent a significant portion of a company's total cost of revenue (COR), some IT departments have already taken the drastic step of "repatriating" the majority of workloads or — in other cases — adopting a hybrid approach. Dropbox is a very well-known example. In 2017, Dropbox stated that it had saved over $70 million in the two years prior to going public by optimizing its infrastructure, the majority of which came from repatriating workloads from the public cloud.

Cloud profitability is very much related to the economic metrics of a company. As growth often slows with scale, short-term efficiency becomes an increasingly important determinant of value in public markets. Based on benchmarking of public software companies, Andreessen Horowitz found that contractually committed spending is on average 50% of the COR. Actual spending as a percentage of COR is typically even higher than committed spending: A private software company with $1 billion in revenue told Andreessen Horowitz that its public cloud spend was over 80% of revenue, and that "cloud spend of this magnitude is common among software companies".

When these benchmarks are extrapolated to software companies that use a public cloud for their infrastructure, a rough estimate from Andreessen Horowitz shows that the cloud bill for 50 of the largest publicly traded software companies reaches $8 billion in total. Based on conversations with experts, Andreessen Horowitz projects that scaling back cloud spending will result in a 50 percent reduction in cloud spending, leading to $4 billion in total recaptured savings. For the broader universe of large public software and Internet companies using cloud infrastructure, that number is likely higher.

What is cloud monitoring?

Cloud monitoring uses manual and automated tools to monitor, analyze, and report on the availability and performance of websites, servers, or applications. Admins could use a cloud monitoring tool to check the performance and reliability of an application to ensure that it is running at its best.

Cloud monitoring is typically performed as part of an overall cloud management strategy, allowing IT administrators to check the operational status of cloud-based resources. It also provides a holistic and useful view of various cloud metrics. There are many cloud monitoring vendors out there today —although their solutions are somewhat diverse.

Individual cloud-based services are provided by solutions from Google and Microsoft. Google's solution, Google Stackdriver, allows users to track performance data from applications running in the public cloud. This service performs diagnostic, logging and monitoring tasks that can be used for cloud optimization. Google Stackdriver is a native GCP product, but can also be used to monitor applications and virtual machines running on AWS EC2. In comparison, Microsoft Azure Monitor collects and analyzes data and resources from cloud environments to determine application availability and performance. Azure Monitor aggregates three types of data: diagnostic logs, activity logs, and performance metrics. It is able to provide insights into the operation of applications, containers and VMs in the cloud.

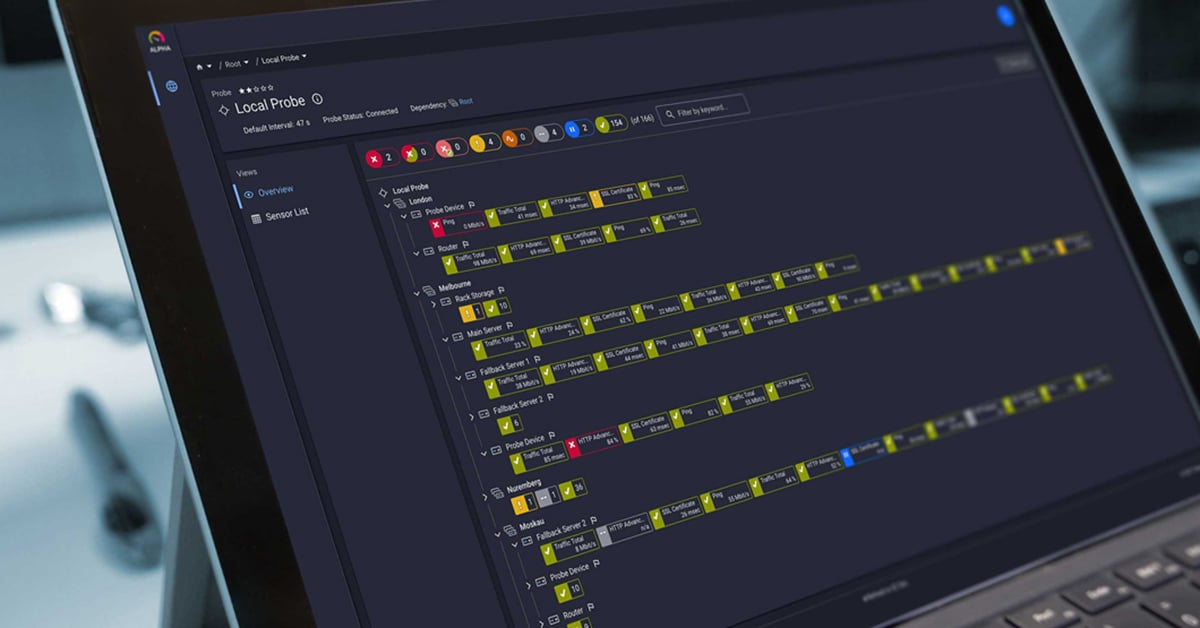

The way to go: comprehensive cloud monitoring

Independent and at the same time comprehensive IT monitoring — as offered by Paessler PRTG — can deliver useful results in the area of cloud monitoring in multiple ways. Apart from the fact that it obviously covers the classic repertoire of IT monitoring as well as the various challenges of the cloud, we'd like to give 3 concrete examples:

- Infrastructure as a Service (IaaS): Many companies are getting into cloud services by adding virtual server capacity. Amazon does offer its own CloudWatch solution. But often the IT department has different accounts for different services or even from multiple providers.

- Software as a Service (SaaS): Many departments require specific software for their work, which is increasingly only offered as SaaS solutions. In addition, an increasing number of companies are switching to solutions such as Microsoft Office 365. Many email services are ultimately also cloud solutions that are in use virtually everywhere.

- Platform as a Service (PaaS): There are numerous PaaS services that provide a development environment. The services can often be used without much administrative effort and without one-time high acquisition costs. So it is not surprising that more and more companies are turning to the popular PaaS services. Development work in particular is highly sensitive. If failures occur here, high costs are incurred. With a comprehensive monitoring service, administrators can keep an immediate eye on everything.

Published by

Published by